The snowball vs. avalanche method, can help you chip away at debt balances and achieve financial freedom. You’re not alone. This blog post dives into the snowball and avalanche methods, unpacking their pros and cons to help you pick the strategy that best suits your personality and financial goals.

Snowball vs. Avalanche Method

The snowball and avalanche methods are two famous debt repayment schemes, each with their own set of perks and cons. Here is a breakdown to help you decide which strategy is best for you:

Snowball Method

The snowball approach is a debt repayment strategy in which you pay off your smallest bills first, regardless of interest rate. It’s a popular choice among many people because it focuses on earning quick wins and providing a motivational boost throughout the debt payback process.

Here’s a deeper dive into the snowball method:

How it Works:

- List Your Debts: Create a list of all your debts, including the total balance and minimum payment for each.

- Smallest Balance First: Order your debts from the smallest balance to the largest balance, regardless of interest rate.

- Attack the Smallest: Focus all your extra payments towards the debt with the smallest balance. Make the minimum payment on all other debts.

- Celebrate and Repeat: Once you pay off the smallest debt, celebrate your accomplishment. Then, take the money you were paying towards that debt (the minimum payment + any extra payments) and roll it over to the next smallest debt on your list. This “snowball” effect grows as you eliminate debts, allowing you to pay off larger ones faster.

Pros of the Snowball Method:

- Psychological Boost: Seeing quick wins with small debts conquered can be incredibly motivating. This keeps you engaged and helps you stay on track with your debt repayment plan.

- Simpler to Manage: The snowball method requires less complex calculations compared to the avalanche method. This makes it easier to follow, especially for those new to debt repayment strategies.

- Increased Motivation: The snowball method promotes a sense of accomplishment as you eliminate debts one by one. This keeps you motivated and focused on reaching your ultimate goal of becoming debt-free.

Cons of the Snowball Method:

- It May Cost More in Interest: Because you are not prioritizing debts with the highest interest rates first, you may end up paying more overall interest in the long term.

Who Should Consider the Snowball Method? - Those that require a motivating boost: If you find rapid wins motivating, the snowball method’s emphasis on modest victories may be a good fit.

- Individuals who are new to debt repayment: The snowball method’s simplicity makes it an accessible technique for beginners.

- Individuals that struggle to remain focused on long-term goals: The snowball method’s emphasis on accomplishing milestones can help you stay motivated during the debt repayment process.

- The snowball method relies heavily on consistency for success. Automate payments, measure progress, and celebrate your accomplishments. Even tiny moves forward accumulate tremendously over time.

The snowball method can be an effective tool for overcoming debt and achieving financial freedom. If you enjoy the motivational component and seeing immediate results, this technique may be suitable for you.

Related: Local Support: Using Your Finances To Boost Your Community

Avalanche Method

The avalanche technique is another popular debt repayment strategy, but unlike the snowball method, it concentrates on paying off the debts that will cost you the most in the long term. Here’s an overview of the avalanche method to help you decide whether it’s the best solution for your debt payback journey.

Targeting High-Interest Debts.

- The avalanche technique promotes repaying loans with the highest interest rates first, regardless of outstanding balance. This technique is designed to save you the most money on interest payments over time.

The Avalanche in Action:

- List Your Debts: Create a comprehensive list of all your debts, including the total balance, minimum payment, and annual percentage rate (APR) for each.

- Highest Interest First: Order your debts from the highest APR to the lowest APR, regardless of the current balance.

- Target the Expensive One: Allocate all your extra payments towards the debt with the highest interest rate while making the minimum payment on all other debts.

- Avalanche the Rest: Once you pay off the debt with the highest interest rate, move on to the next highest APR on your list. Repeat this process until you’ve eliminated all your debts.

Pros of the Avalanche Method:

- Saves Money on Interest: By prioritizing high-interest debts, you save a significant amount of money in interest charges over time. This can be a substantial benefit, especially for those with large debts and high APRs.

Cons of the Avalanche Method:

- Demoralizing at First: Seeing little progress on smaller debts initially can be discouraging. This method requires a strong commitment and a long-term perspective to stay motivated.

- More Complex Calculations: The avalanche method might require more planning and calculations to ensure you’re allocating funds correctly, especially when dealing with multiple debts and changing balances.

Related: Financial Goals: Tips To Boost Your Bank Account

Who Should Consider the Avalanche Method?

Individuals who are financially disciplined: The avalanche technique necessitates a dedication to the long-term goal as well as the ability to remain focused even when progress appears slow.

- People with high-interest debts: If you have a large amount of debt with high APRs, the avalanche method can save you far more money in interest than the snowball method.

- Individuals that are analytical and detail-oriented: The avalanche method needs more preparation and calculations, which may appeal to those who want a more strategic approach.

- Consistency is essential. Automate your payments, track your progress, and celebrate even the smallest accomplishments. Every bit contributes to your debt-free future.

The avalanche method is a strong strategy for folks that prioritize saving money on interest and are comfortable with a long-term approach. If you’re disciplined and analytical, the avalanche method could be the right tool to help you crush your debt.

Choosing Your Method:

Here are some factors to consider when deciding:

- Personality: Are you motivated by quick wins (snowball) or a strategic, long-term approach (avalanche)?

- Debt Load: If you have many small debts, snowball might be better initially. If you have a few large, high-interest debts, avalanche could save you money.

- Discipline: Avalanche requires discipline to stay focused on the long-term goal.

- Both methods can help you achieve debt-free status. Choose the one that best suits you and your goals.

Additional Tips:

- Regardless of the method, consider making extra payments whenever possible to accelerate your debt payoff.

- Explore resources like budgeting apps or credit counseling services to support your journey.

You can pave the way for a brighter financial future, by taking control of your debt. So, grab your metaphorical shovel, choose your method, and get ready to snowball or avalanche your way to debt freedom.

Related: Sustainable Spending: Making Eco-Friendly Choices That Save You Money

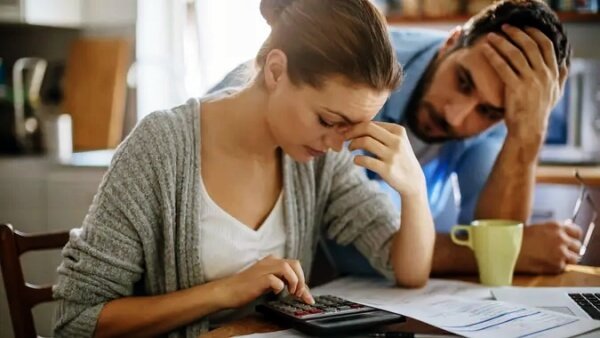

Mistakes To Avoid When Paying Down Debt

Although it’s a journey of empowerment, paying off debt is not without difficulties. When pursuing financial independence, avoid the following typical mistakes:

- Lack of Plan: Struggling without a plan will just lead to discouragement. Make a budget that lists all of your debt commitments, spending, and income. Calculate the monthly amount that you can reasonably devote to debt repayment.

- Only Minimum Payments: The minimal payment is the absolute least amount needed to prevent your account from being past due. Long-term debt accumulation results in substantial interest charges. To hasten the discharge of your debt, make additional payments whenever you can.

- Not Prioritizing High-Interest Debts: High-interest debts like credit cards can snowball quickly. Decide on a debt repayment method (snowball or avalanche) that works for you and prioritize high-interest debts to save money on interest charges in the long run.

- Ignoring the Root Causes: Debt often arises from underlying spending habits. Reflect on your spending triggers and develop strategies to curb unnecessary expenses. Consider implementing a no-spend challenge or setting savings goals alongside your debt repayment plan.

- Closing Accounts Too Soon: While it might be tempting to close paid-off credit card accounts, a longer credit history with a good track record can positively impact your credit score. Consider keeping older accounts with low credit utilization (the amount of credit used compared to the total limit) open to improve your creditworthiness.

- Not Tracking Progress: Monitoring your progress is essential for staying motivated. Regularly review your budget and track your debt payments. Celebrate milestones, big and small, to maintain momentum and focus on your goals.

- Temptation Trap: Unexpected expenses or social pressures can derail your debt repayment plan. Develop coping mechanisms to resist impulsive spending. Utilize cash envelopes or a designated debit card for everyday purchases to avoid relying on credit cards.

- Going it Alone: Debt repayment can be overwhelming. Don’t be afraid to seek support. Talk to a trusted friend or family member about your financial goals. Consider consulting a credit counselor for professional guidance and advice tailored to your specific situation.

Related: Closing The Gender Gap: Empowering Women Through Financial Literacy

Snowball Vs Avalanche Method Example

Let’s illustrate the snowball and avalanche methods with a real-life scenario to see how they play out and help you decide which might be a better fit for you.

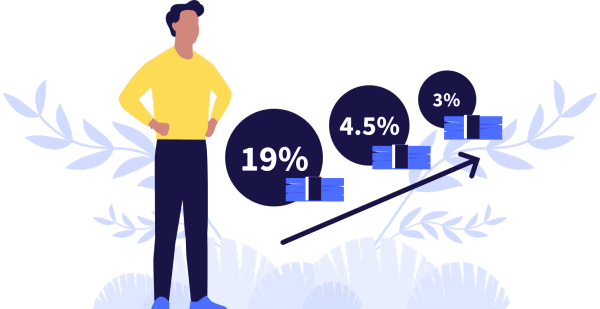

Meet Sarah: Sarah has a credit card debt of $2,000 with a 15% APR, a student loan debt of $5,000 with a 7% APR, and a car loan debt of $8,000 with a 5% APR. She can comfortably allocate an extra $300 per month towards her debts on top of the minimum payments.

Snowball Method:

Ordering Debts: Sarah lists her debts from smallest to largest balance:

Credit Card: $2,000 (15% APR)

Student Loan: $5,000 (7% APR)

Car Loan: $8,000 (5% APR)

- Attack the Smallest: Sarah throws all her extra payments ($300) at the credit card, the smallest debt. It takes her 7 months to pay it off completely.

- Roll the Snowball: Sarah takes the money she was paying towards the credit card ($300) and adds it to the minimum payment for the student loan (let’s assume the minimum payment is $100). Now she’s paying $400 per month towards the student loan.

- Repeat and Celebrate: With the increased payment, Sarah pays off the student loan in 12 months. Finally, she tackles the car loan with a total payment of $700 (original $300 extra payment + $400 freed-up payment from student loan). It takes her 11.4 months to pay off the car loan.

Total Time: 2 years and 9 months

Total Interest Paid (estimated): $930 (This is an estimate as the exact interest paid will depend on the minimum payment amounts and specific billing cycles)

Related: Value Of Networking: Building Global Connections As An International Student

Avalanche Method:

Ordering Debts: Sarah prioritizes debts by highest interest rate first:

Credit Card: $2,000 (15% APR)

Student Loan: $5,000 (7% APR)

Car Loan: $8,000 (5% APR)

- Target the Expensive One: Sarah focuses all extra payments ($300) on the credit card, the debt with the highest interest rate. She pays it off in 7 months.

- Avalanche the Rest: Sarah allocates the extra payment towards the student loan next (let’s assume the minimum payment is $100). Now she’s paying $400 per month towards the student loan.

- Debt Disappearing Act: Due to the higher interest rate paid off initially, Sarah pays off the student loan in 11 months (slightly faster than the snowball method). She then tackles the car loan with a total payment of $700 and eliminates it in another 11.4 months.

Total Time: 2 years and 7 months

Total Interest Paid (estimated): $800 (This is an estimate as the exact interest paid will depend on the minimum payment amounts and specific billing cycles)

The Outcome:

As you can see, the avalanche method saves Sarah a little over $130 in interest by prioritizing high-interest debt first. However, it takes her two months longer to completely pay off all her debts compared to the snowball method.

So, Which Method Should Sarah Choose?

The answer depends on Sarah’s personality and priorities. Here’s a breakdown to help her decide:

- Motivation: If Sarah thrives on quick wins, the snowball method’s early debt elimination might be more motivating.

- Discipline: The avalanche method requires a long-term perspective. If Sarah can stay focused on the bigger goal, it can save her money.

- Simplicity: The snowball method is easier to manage, while the avalanche method might require more calculations.

Ultimately, both methods can help Sarah achieve her debt-free goals. She should choose the approach that best aligns with her financial situation and personal preferences.

Related: Building An Emergency Fund: Your Safety Net For Life’s Curveballs

Snowball Vs Avalanche Calculator

While there is no universally accepted snowball vs avalanche calculator, various online resources may assist you estimate the payout period and total interest paid using each strategy. There are a few options to consider:

Online Debt Payoff Calculators:

Several websites include debt payback calculators that let you compare the snowball and avalanche strategies. Here are two popular choices:

NerdWallet Debt Payoff Calculator.

These calculators often need you to enter information about your loans, including:

- Balance of each debt

- The interest rate (APR) for each debt

- Minimum payment for each loan.

- Additional monthly payments might be allocated towards debt repayment.

- The calculator will then calculate how long it would take to pay off your debts using the snowball and avalanche approaches, as well as the total interest paid in each scenario.

Spreadsheet apps:

If you are familiar with spreadsheet programs such as Microsoft Excel or Google Sheets, you can make your own snowball vs. avalanche calculator. Here’s the basic framework:

- Create a table with columns for the debt name, balance, interest rate, minimum payment, and additional payment.

- Enter details about each of your debts.

- Include separate sections for Snowball and Avalanche methods.

- In the Snowball section, calculate the total monthly payment by adding the minimum payment and additional payment. List the smallest debt first.

- Simulate monthly payments by subtracting the total monthly payment from the balance of the first debt. In the next month’s row, update the balance with the remaining amount.

- Repeat for the next smallest debt once the first debt is paid off. Include the freed-up additional payment from the previous debt in the total monthly payment calculation for the new debt.

- Track the total number of months it takes to pay off all debts and calculate the total interest paid based on the original balance and interest rate for each month the debt was outstanding. (This might require a separate formula for each debt).

- Repeat the process for the Avalanche section, prioritizing the debt with the highest interest rate first.

Advisor for Finances:

- Get individualized advice on your debt repayment strategy by speaking with a financial advisor. With their access to more advanced tools for debt payment calculations, they can assist you in selecting the best approach based on your financial status and objectives.

- Estimates are provided by these calculators and programs. Variations in the minimum payment and certain billing cycles are two examples of issues that could affect the actual outcomes. Maintaining consistency is essential, no matter which approach you take. To speed up your debt repayment process, concentrate on making consistent payments and strive to pay more than the minimal amount whenever you can.

Related: Tech Tips For Securing Education, Health, And Financial Peace Of Mind

Conclusion

Whichever method you choose, remember, consistency is key. Automate your payments, track your progress, and celebrate your milestones. Both the snowball and avalanche methods can help you achieve financial freedom. Pick the one that best suits you, and get ready to crush your debt.